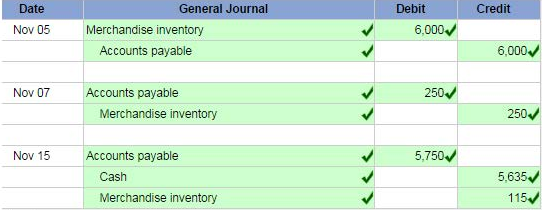

Nov. 5 Purchased 600 units of product at a cost of $10 per unit. Terms of the sale are 2/10, n/60; the

invoice is dated November 5.

Nov. 7 Returned 25 defective units from the November 5 purchase and received full credit

Nov. 15 Paid the amount due from the November 5 purchase, less the return on November 7.

Prepare the journal entries to record each of the above purchases transactions of a merchandising

company. Assume a perpetual inventory system.

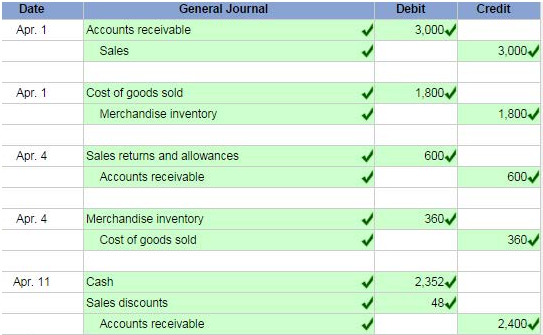

Apr. 1 Sold merchandise for $3,000, granting the customer terms of 2/10, EOM; invoice dated April 1.

The cost of the merchandise is $ 1,800.

Apr. 4 The customer in the April 1 sale returned merchandise and received credit for $600. The

merchandise, which had cost $360, is returned to inventory.

Apr. 11 Received payment for the amount due from the April 1 sale less the return on April 4.

Prepare journal entries to record each of the above sales transactions oi a merchandising company.

Assume a perpetual inventor/ system.

No comments:

Post a Comment